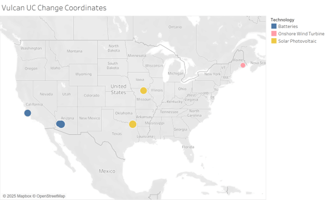

This week, we confirmed five battery projects and one solar plant, meaning our initial satellite...

China's Regasification Expansion – Key Insights & Project Updates

Analysis of China's Regasification Build-Out - Client Version

This week, in collaboration with the Leviaton team, we analyzed the critical expansion of regasification capacity in China. Currently possessing the world's second-largest regasification capacity at 168 million tonnes per annum (MTPA). China's projected expansion is estimated at approximately 60 MTPA over the next two years, making it the country with the largest regasification capacity by 2027, after Japan (217 MTPA). Our analysis focused on validating and confirming the status of projects currently under construction, many of which experienced significant delays due to the COVID-19 pandemic.

.png?width=512&height=305&name=unnamed%20(9).png)

We also examined regasification plants completed in recent years, researching construction timelines (from initial land clearing to first structure) using a methodology similar to our power plant analysis. Specific indicators, such as the clearing of land or construction of offshore islands, the construction of storage tanks, and other observable milestones, typically signal the completion of a project's construction phase. Ideally, this is followed by the arrival of an LNG vessel at the terminal. Our updated terminal dataset will include the date of the first vessel arrival for each new terminal, and we plan to issue alert reports upon such an event.

.png?width=512&height=321&name=unnamed%20(10).png)

Our analysis reveals a wide range of construction timelines for regasification plants, from as short as 279 days from first structure to over 2,000 days from first land clear, with the later primarily due to COVID-related disruptions.

Applying the shortest observed project timelines provides a high degree of certainty regarding the earliest possible online dates for these projects. A significant portion of the under-construction projects could potentially be operational now. In fact, our analysis suggests that 8 of the 15 identified regasification projects appear to be complete. Of these eight, we have not seen an LNG vessel, but we have observed some NGL vessels appear at the site.

Based on satellite imagery, historical construction schedules, and official announcements, we anticipate 11 new terminals in 2025, 5 in 2026, and 2 in 2027. This expanded capacity will likely provide China with greater flexibility in managing gas demand, which in turn should stimulate increased LNG imports.

.png?width=512&height=351&name=unnamed%20(11).png)

Vulcan & Leviaton clients can access the LNG-specific data through Vulcan, either by downloading the dataset or via API or Snowflake for project-specific information. The UI will also offer the satellite images as demonstrated in the below highlighted plants.

Highlighted Plants:

1. Yantai LNG Terminal Phase 1

With a nameplate capacity of 5.9 MPTA, the Yantai LNG project is the second LNG facility at the Yantai port in Shandong province to come online this year after Sinopec’s Longkou LNG terminal (6.5 MPTA). Satellite imagery from SynMax Vulcan UC shows that the project’s land was first cleared in September 2018 for construction, and initial structures were observed in December 2020. However, construction was delayed, postponing the originally anticipated 2022 operational date set by the parent company, Yantai Energy Investment. Our images confirm that all five 200,000 cubic meter storage tanks were completed by October 2023 along with two jetties and appeared to be fully completed by November 2024. The project will be integrated with the Shandong Gas Pipeline via a 530km pipeline and is expected to receive its first LNG vessel in 2025.

2/15/2025

.png?width=337&height=337&name=unnamed%20(12).png)

2. Ganyu LNG Terminal

Located at Ganyu port in Lianyungang, Jiangsu province, the Ganyu LNG terminal is a 3 MTPA import facility. Originally proposed for commissioning in 2020, the project faced permit delays and was only approved in 2022 by the central government as a part of the province’s 14th Five-Year Plan. Satellite imagery from Synmax Vulcan UC indicates that land clearing for three storage tanks began in August 2023, and construction of a jetty is also visible. According to China Huadian, the project’s owner, the terminal is expected to be fully operational by 2026, supplying gas to both Jiangsu and the broader Yangtze River Delta region.

2/16/2025

.png?width=360&height=360&name=unnamed%20(13).png)

3. Zhejiang Energy Liuheng LNG Terminal Phase 1

The Zhejiang Energy Liuheng LNG terminal, an import facility with a capacity of 6 MTPA secured its land use rights in October 2020 on the Liuheng Island in Zhejiang province. Vulcan UC satellite imagery shows that land clearance took place in July 2022, and the first structures emerged in February 2024. The project, which includes four 200,000 cubic meter storage tanks and a 266,000 cubic meter LNG berth, appears to have reached full completion as of images observed on January 13, 2025. The project aims to enhance the storage and peak shaving capacities in East China, and is expected to welcome its first LNG vessel in late 2025.

2/16/2025

-1.png?width=361&height=361&name=unnamed%20(14)-1.png)