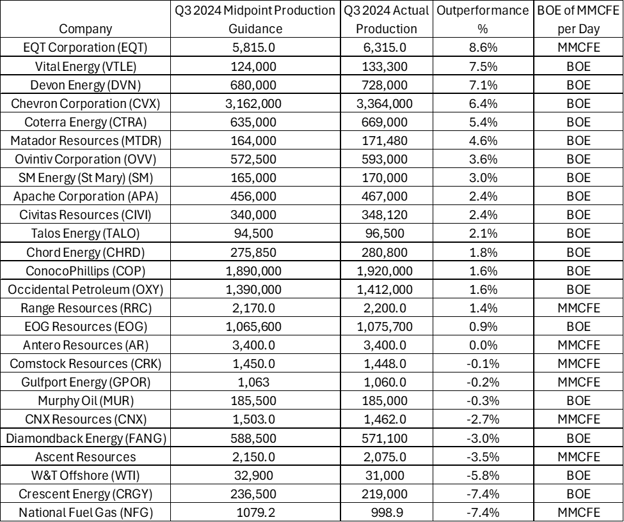

Producer Performance Scorecard

The table below illustrates how each publicly traded producer performed (or produced) relative to the midpoint of their quarterly production guidance before they released earnings and actual production numbers. Q3 2024 actual production and Q3 2024 midpoint guidance numbers are shown in the table since this is the latest quarterly production data.

Dominant natural gas producers report actualized and guidance production data in MMCFE per day and dominant crude oil producers list actualized and guidance production data in BOE per day. Most producers outperform relative to the midpoint of their production guidance as they usually give a conservative estimate to equity analysts so they can outperform on earnings and have a potential boost to the stock price. Not surprisingly, approximately 62% of producers in the table produced above the midpoint of their Q3 2024 quarterly guidance estimate.

The outperformance by EQT was probably due to an overly conservative estimate on Q3 2024 production guidance. The Q3 2024 guidance range for EQT was nearly 8% wide and the company had planned for a lot more curtailments in production than what was ultimately implemented during the 3rd quarter. Some of Vital Energy’s production outperformance is due to the acquisition of Point Energy. Chevron’s outperformance is susceptible to planned overseas production maintenance events that don’t materialize.