*|MC:SUBJECT|*

Vulcan Insights: Dark Spreads Signalled Shift

*|MC_PREVIEW_TEXT|*

Dark Spreads Signalled Shift to Gas Power Generation

VULCAN INSIGHTS

As discussed last week, Vulcan has added dark spreads (coal plant profit margins) to its platform to provide users with a deeper understanding of the dynamics at play between coal and gas power generation.

Clients of Vulcan will now have access to daily dark spreads for various regions.

Recent Trends

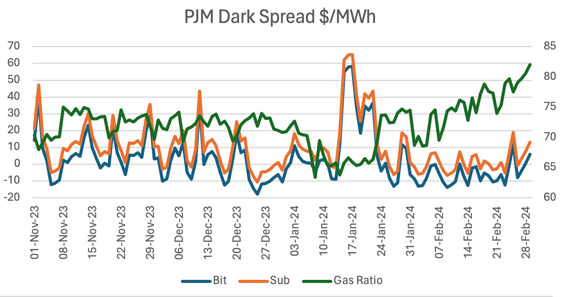

November-December 2023

During this period, positive dark spreads moments created gas ratio in the range of 70-75%.

January 2024

The winter months saw a shift towards coal use due to increased demand for electricity. This corresponded with a significant spike in dark spreads, producing gas ratios below 70%.

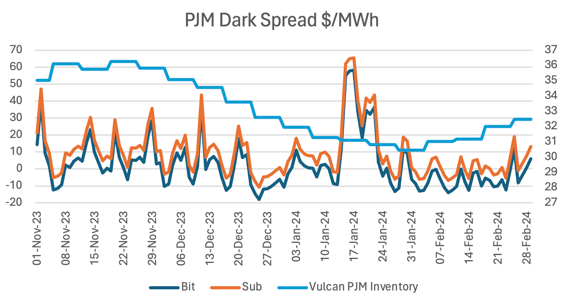

February 2024

Negative dark spreads persisted throughout February producing 80+% gas ratios. Coal inventories are starting to grow.

The winter months saw a shift towards coal use due to increased demand for electricity. This corresponded with a significant spike in dark spreads, producing gas ratios below 70%.

February 2024

Negative dark spreads persisted throughout February producing 80+% gas ratios. Coal inventories are starting to grow.

Looking Ahead

While dark spreads may show some slight improvement in the future, it is unlikely that they will reach a point where significant coal burning becomes economically favorable again. This would likely only occur in response to extreme weather events that significantly impact energy demand.

Coal inventories are expected to climb in the coming months.

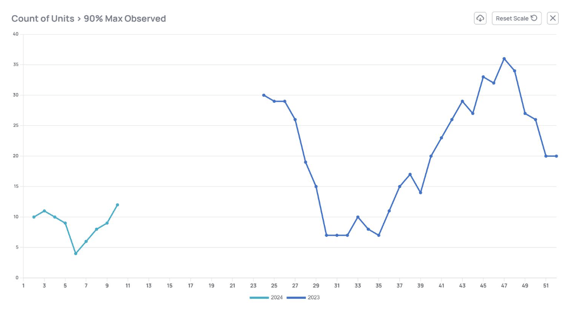

However, the speed of this increase and the eventual impact on gas demand models remain uncertain. While some individual coal plants are starting to show high inventories, there is still room for coal inventories to climb allowing gas to continue to show a high ratio.

While dark spreads may show some slight improvement in the future, it is unlikely that they will reach a point where significant coal burning becomes economically favorable again. This would likely only occur in response to extreme weather events that significantly impact energy demand.

Coal inventories are expected to climb in the coming months.

However, the speed of this increase and the eventual impact on gas demand models remain uncertain. While some individual coal plants are starting to show high inventories, there is still room for coal inventories to climb allowing gas to continue to show a high ratio.

Vulcan Advantage

By utilizing Vulcan, you gain access to these valuable insights 2-3 months ahead of the release of official market data. This significant head start allows you to make informed adjustments to your gas demand forecasts from the power sector, giving you a competitive edge in the market.

.png?height=200&name=unnamed%20(70).png)