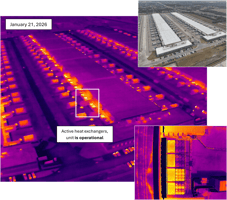

Datacenters Added to our Database In the latest update by our team, we have added all units...

Vulcan Agent Solves the Timeline Mystery

|

SynMax Research: A frequent piece of feedback we have received from both prospects and existing clients is that while our data and intelligence are excellent, they are swimming in the current volume of information. They require more resources to effectively understand and process our data. We have solved this problem with the Vulcan Agent. The Vulcan Agent provides you with in-depth analysis whenever you need it. For example, the data accessible through Vulcan goes far beyond our specific forecasts; we have integrated all EIA-860M filings dating back to 2015. The following question was recently asked of the Agent: “Are projects coming online faster or slower than in the past you can use the first seen column to analyze this by technology?” Few minutes later the results showed a slowing particularly for solar and I realized it is not taking into account projects are getting larger so I had to add a prompt: “Review this on a per MW as larger projects should take longer.” Few minutes later it did show some results but I noticed in the chart it had 2024 first seen results for combined cycle. I know for a fact that no combined cycle came on operation that year (first time since 2000). I asked the agent and like a first year analyst it had used a forecast of online dates. I had to ask it to remove future dates and do the analysis on only operational dates. Few minutes later: ## **CORRECTED ANALYSIS: Power Plant Development Efficiency 2016-2024** ### *(Based ONLY on Actual Operational Dates - No Future Projections)* --- ## **📊 Executive Summary** When normalized by capacity (days per MW), **renewables and storage are building faster than ever**, while **natural gas combined cycle projects are experiencing significant slowdowns**. The energy transition is accelerating in deployment speed, not just capacity. --- ## **🎯 Key Findings: Efficiency Comparison (2016-2018 vs 2022-2024)** | Technology | Early Days/MW | Recent Days/MW | **Efficiency Change** | Project Size Change | |------------|---------------|----------------|----------------------|---------------------| | **Batteries** | 84.30 | 37.43 | **↓ 56% FASTER** 🟢 | +440% (11 → 62 MW) | | **Onshore Wind** | 26.37 | 13.02 | **↓ 51% FASTER** 🟢 | +29% (130 → 168 MW) | | **Solar Photovoltaic** | 93.66 | 63.93 | **↓ 32% FASTER** 🟢 | +214% (13 → 39 MW) | | **Natural Gas Combustion Turbine** | 15.50 | 14.21 | **↓ 8% FASTER** 🟢 | +41% (34 → 48 MW) | | **Offshore Wind** | No data | 6.56 | **NEW (2022+)** 🆕 | N/A | | **Natural Gas Combined Cycle** | 4.21 | 6.84 | **↑ 63% SLOWER** 🔴 | -84% (303 → 49 MW) | --- ## **💡 Technology-Specific Insights** ### **🔋 Batteries - Most Dramatic Improvement** - **56% efficiency gain** (84 → 37 days/MW) - Projects grew **440%** in average size (11 MW → 62 MW) - Total capacity deployed: **57,819 MW** in recent period (vs 3,091 MW early period) - **Key driver**: Rapidly maturing technology, standardized equipment, simplified permitting - **Industry leader**: Despite being newest utility-scale technology, showing steepest learning curve

### **💨 Onshore Wind - Mature Technology Accelerating** - **51% efficiency gain** (26 → 13 days/MW) - Projects grew **29%** larger (130 MW → 168 MW) - Total capacity deployed: **17,612 MW** in recent period - **Most efficient per-MW technology** in 2022-2024 period (13.02 days/MW) - **Key driver**: Decades of experience, established supply chains, streamlined processes

### **☀️ Solar Photovoltaic - Consistent Volume Leader** - **32% efficiency gain** (94 → 64 days/MW) - Projects grew **214%** in size (13 MW → 39 MW) - **Highest project count**: 18,153 projects in recent period (vs 5,041 early period) - Total capacity deployed: **70,949 MW** in recent period - **Key driver**: Modular design allows faster construction, cost declines enabling larger projects

### **🌊 Offshore Wind - New Entrant Excellence** - Only **6.56 days/MW** in 2022-2024 (no early period data) - **Most efficient overall** among all technologies with data - Average project size: **146 MW** - Total capacity: **876 MW** (6 projects only, but highly efficient) - **Key insight**: Despite being newest utility-scale technology, extremely efficient deployment

### **⚡ Natural Gas Combustion Turbine - Stable Performer** - **8% efficiency gain** (15 → 14 days/MW) - Projects grew **41%** (34 MW → 48 MW) - Total capacity: **11,002 MW** in recent period - **Key insight**: Smaller, simpler units maintain consistent timelines; used for peaker plants

### **🔥 Natural Gas Combined Cycle - ONLY Technology Deteriorating** - **63% WORSE efficiency** (4 → 7 days/MW) 🚨 - Projects became **84% SMALLER** (303 MW → 49 MW) - **Massive decline in activity**: 6,760 projects early period → only 66 projects recent period - Total capacity collapsed: **2,045,980 MW** early period → **3,245 MW** recent period - **Key drivers**: - Declining investment in new fossil fuel generation - Increased regulatory scrutiny and permitting challenges - Market shift toward renewables and storage - Smaller, less economical projects being built - **Data anomaly**: 2022 shows 0.0 days/MW (likely database entry artifacts) --- ## **📈 What the Chart Shows** The line chart displays development efficiency trends from 2016-2024, with each technology represented by a distinct colored line: **📉 Downward Trends (Improving Efficiency):** - **Batteries (Red)**: Steep decline from ~84 to ~37 days/MW - **Onshore Wind (Blue)**: Steady improvement from ~26 to ~13 days/MW - **Solar (Purple)**: Consistent decline from ~94 to ~64 days/MW - **Gas Turbine (Gold)**: Slight improvement, relatively stable ~14-15 days/MW

**📈 Upward Trend (Worsening Efficiency):** - **Combined Cycle (Green)**: Rising from ~4 to ~14 days/MW (ends at 2023) - Notable spike to 119 days/MW in 2021 (outlier year with only 7 projects) - 2022 shows 0 days/MW anomaly (44 projects, likely data entry issue)

**➡️ Limited Data:** - **Offshore Wind (Orange)**: Only appears 2022-2024, very efficient at ~6-7 days/MW --- ## **🎯 Bottom Line** ### **The Energy Transition is Accelerating:**

### **Key Insight:** Your original observation was correct - **absolute timelines increased because projects got bigger**. But the corrected per-MW analysis reveals the real story: **the industry is building clean energy infrastructure faster and more efficiently than ever before**, while traditional fossil fuel development faces mounting challenges. --- **Data Quality Note**: Analysis excludes all projects with future operational dates (2025+) to ensure accuracy. The following chart was made.

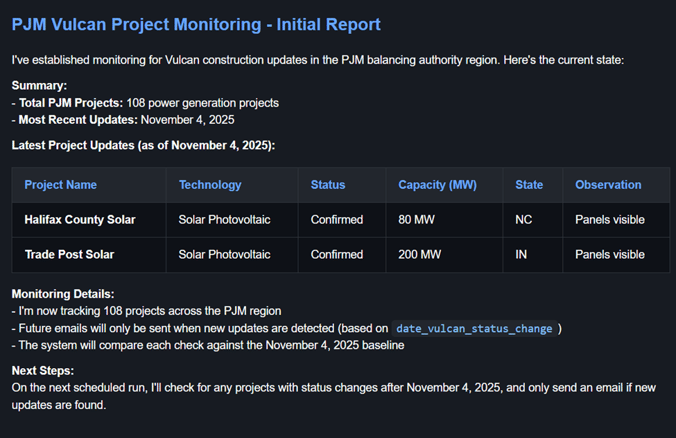

The Agent was wise on its own to conduct the analysis using the distinct periods of 2016–2018 vs. 2022–2024. When I asked it why it chose these dates, it cited the impact of COVID and the need to create a symmetrical analysis. Not bad! I think I will forgive this "first-year worker" for its previous mistake regarding future dates and not initially realizing projects are getting larger, given this insightful thought. Once again, policy and policymakers do have an impact. The anti-fossil fuel stance, particularly the opposition to natural gas, has slowed and eliminated the building of Combined Cycle power plants in the U.S. These plants are now very much needed as data center load growth accelerates. The Agent successfully concluded the issue related to natural gas and logically justifying the improvements on other technologies but one does need to question the result as you would do with any first year analyst. Agent Functionality and Efficiency One can also schedule tasks such as: "Review the data and send me updates when a project in PJM is updated in Vulcan." Our Agents can be used to create better workflow efficiency.

The Vulcan platform, with its unique proprietary information combined with the Agent, makes a very compelling case. Clients wanting to access the Vulcan agent please go to agents.synmax.com and enter your API key. Interested in a demo and becoming a client of the premier infrastructure monitoring product? Please reach out to our Lead Researcher, David Bellman at dbellman@synmax.com. |