SynMax Research:

Corpus Christi Stage 3: Thermal Analysis Confirms Train 3 in Testing

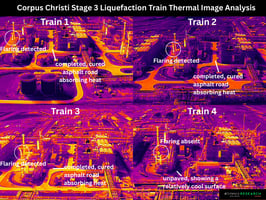

As a special report to our Hyperion and Vulcan clients, SynMax Research conducted thermal imaging surveillance of the Corpus Christi Stage 3 liquefaction facility on September 13, 2025. Our objective was to assess the operational status of Train 3 within the seven-train expansion project.

While our Vulcan platform's satellite imagery confirms that Train 3 is largely complete and Train 4 is progressing, satellite views have limitations in detecting when a facility is truly energized. Each liquefaction train has a nameplate capacity of approximately 1.49 MTPA (0.2 Bcf/d).

Our thermal analysis found that temperature signatures from Train 3 ranged from 84.9°F to 103.5°F, which is substantially cooler than the 132.8°F to 225.3°F range observed at the fully operational Trains 1 and 2. This confirms that no LNG production was detected at the time of our analysis.

Based on these findings, we anticipate Train 3 commissioning to begin in October or November 2025. Following historical patterns, first LNG exports typically occur about two months after commissioning, suggesting initial cargo shipments from Train 3 in December 2025. This timeline will add incremental feedgas demand and export capacity to global LNG markets.

Methodology

Thermal cameras captured temperature readings across multiple sections of each liquefaction train and supporting infrastructure. Temperature data serves as a primary indicator of operational status, as active liquefaction processes generate significant heat signatures from feedgas compression and cryogenic processing. The drone captured temperature readings at designated monitoring points across the facility, with measurements taken at both right and left sections of each train to ensure comprehensive coverage.

What the Thermal Data Tells Us

Our drone-mounted thermal cameras captured definitive proof that Train 3 isn't consistently producing LNG yet.

Operational Trains (Currently Pulling Feedgas):

- Train 1: Running hot at 134.4°F - 213.1°F (online since December 2024, exporting since March 2025)

- Train 2: Similar heat profile at 132.8°F - 225.3°F (first cargo August 2025)

- Combined current feedgas demand: ~0.4 Bcf/d

Train 3 Status:

Thermal imaging analysis confirms Train 3 remains in the testing and commissioning phase. While fan movement was observed on the liquefaction train and flaring activity was documented, these indicators do not constitute evidence of LNG production. Flaring during commissioning represents standard testing procedures for process equipment validation and gas handling systems.

- Temperature range: 84.9°F - 103.5°F across all monitoring points

- This 100°F+ temperature differential confirms zero LNG production

- Visible flaring and fan movement indicate some testing, not consistent production

- Critical point: Flaring during this phase is equipment testing, not feedgas processing

Market Impact Timeline

October-November 2025 (Train 3 Commissioning Expected)

- Additional 0.2 Bcf/d feedgas demand hitting interstate pipelines

- Commissioning process typically requires 2 months before first exports

December 2025 (Train 3 First Exports Expected)

- 1.49 MTPA new export capacity entering global markets

- Total CC Stage 3 capacity reaches 0.6 Bcf/d (Trains 1-3 combined)

Feedgas Flow Detection Limitations

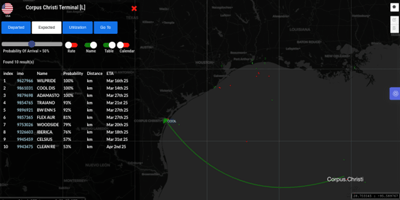

Monitoring feedgas flows to determine Train 3 startup presents analytical challenges. Corpus Christi sources feedgas from intrastate pipeline systems, rendering flow variations at the facility level difficult to isolate. Intrastate pipeline deliveries aggregate multiple receipt and delivery points, obscuring train-specific consumption patterns. SynMax Leviaton can effectively track vessel loading patterns and cargo forecasts to approximate the intrastate feedgas flows in this case, providing visibility into incremental production despite pipeline data limitations.

Infrastructure Development Status (Q4 2025 - Q1 2026 Outlook for CC III)

SynMax Vulcan satellite imagery analysis, as documented in reporting dated March 14, 2025, indicates Train 4 physical structures appear substantially complete with commissioning expected by year-end 2025. Trains 5-7 remain under construction with major structural components not yet visible in ground-level imagery. Continuous satellite monitoring will track construction progress for Trains 5-7.

Marine Loading Infrastructure Constraints

Stage 3 shares marine loading infrastructure with Stages 1 and 2, utilizing two existing LNG loading berths. The addition of Stage 3 capacity increases total facility throughput without corresponding expansion of marine loading infrastructure. As nameplate capacity increases from approximately 15 MTPA (Stages 1-2) to 25 MTPA upon Stage 3 completion, berth utilization rates will intensify. This infrastructure constraint may result in increased vessel queuing at the facility as loading operations become the primary throughput bottleneck.

Vessel Tracking and Export Monitoring

SynMax Leviaton maintains continuous AIS-based tracking of LNG vessels calling at Corpus Christi. The platform provides loading confirmation and destination predictions based on vessel movement patterns and historical flow data. As Stage 3 trains commence operations, vessel traffic density and berth occupancy metrics will serve as supplementary indicators of facility utilization rates.

Conclusion

Our thermal analysis definitively indicates that Train 3 has not commenced consistent LNG production, with some visible initial commissioning activities. The significant temperature differentials between operational and non-operational trains provide a clear demarcation of their status. Anticipated October -November 2025 commissioning will increase the facility's liquefaction capacity by 0.22 Bcf/d, with subsequent trains expected to follow in sequence through 2026.

It should be noted that this thermal imaging represents a single-day snapshot of temperature readings captured on Saturday morning, September 13, 2025. Continuous monitoring would be required to detect the transition from testing to full production operations.

For those interested in thermal video footage and similar thermal imaging analysis at this or other locations, please reach out to us at info@synmax.com or contact our Lead Researcher, David Bellman, at dbellman@synmax.com . While this type of analysis is not a standard, off-the-shelf product, we are certainly open to making it more widely available if we see corresponding market demand.

.png?height=200&name=unnamed%20(57).png)