SynMax Research: SynMax is expanding into the natural gas demand space with the addition of Kyle...

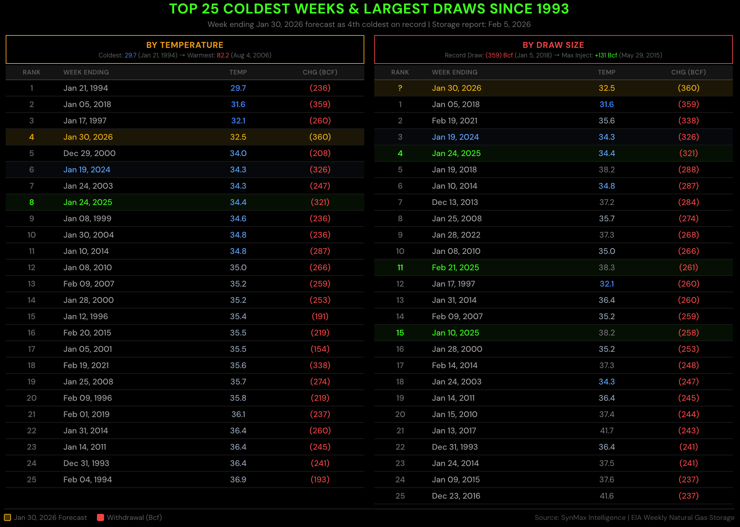

Record 360 Bcf Withdrawal Despite Less Than Record Temperatures

SynMax Research:

In our previous report, “From Warning to Reality: The Return of Winter Volatility”, we noted the extreme nature of the weather forecast that placed the week ending January 30 as the second coldest dating back to 1994, when our temperature index began. At that time, the forecast projected a weekly average temperature index of 30.8 degrees. In reality, temperatures were notably warmer, with the final temperature index measuring 32.5 degrees, placing it 4th since 1994.

While this is clearly still extremely cold, it did not quite reach the extreme severity originally predicted. Despite the slight moderation in realized temperatures, the storage withdrawal of (360) Bcf represents a record withdrawal, eclipsing the (359) Bcf withdrawal from January 5, 2018.

Last week witnessed multiple factors that influenced the (360) Bcf withdrawal, with the cold clearly still the primary driver. On the bullish side, natural gas demand soared as heating load offset the falling temperatures. Electricity demand—partially met by natural gas-fired generation—rose as HVAC systems worked at increasing rates to circulate warm air. In buildings utilizing electric resistance heating, electricity demand spiked significantly as both circulation fans and heating elements consumed power.

It should be noted that while some areas—notably Tennessee, Mississippi, and Louisiana—experienced significant outage rates, overall power outages were considered modest. However, power outages in the Louisiana Haynesville were significant; as noted in our production freeze-off estimates, a total of 43.5 Bcf of production was impacted by the adverse weather.

On the bearish side, whether due to physical weather impacts or economic incentives associated with Henry Hub cash prices soaring over $30, US LNG exports plummeted. Net US LNG exports were estimated to be 26.2 Bcf lower over the reference week.

There were other factors influencing the natural gas market, and current weather forecasts now suggest temperatures are likely to rise above average by February 10. This return to above-average temperatures is noteworthy as seasonal average temperatures are now increasing. The coldest day in the January 30 reference week occurred on January 24 at 29.9 degrees (13.3 degrees below normal). In today’s forecast, the warmest day is projected at 48.1 degrees on February 17 and would be 3.5 degrees above normal. From a projected demand perspective, this is a critical consideration; even below-normal temperatures in the coming weeks will not generate heating-related demand anywhere close to what was just experienced.

Nevertheless, the potential for significant weather-related demand changes remains real, and natural gas prices are still subject to notable moves based on bullish or bearish weather forecast updates.

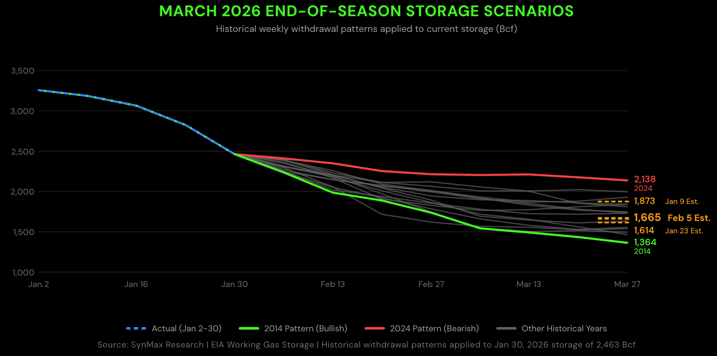

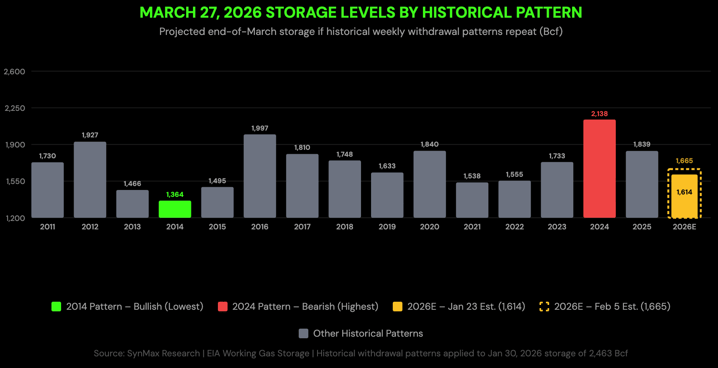

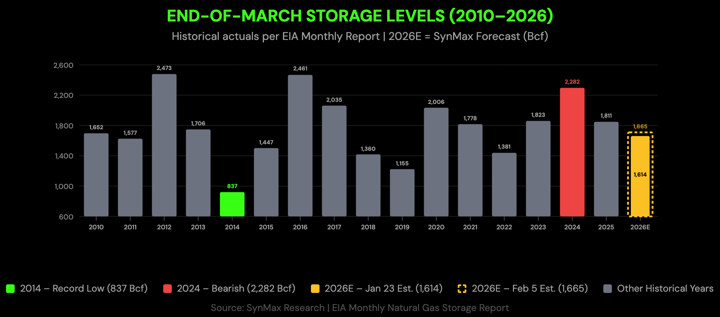

Considering the actual storage changes and updated weather outlook, our January end of month storage level is now projected at 2,427 Bcf with an end of March storage level of 1,665 Bcf. Even this March inventory level contains a wide range of potential outcomes as the replication of 2014 changes drops March inventories to 1,364 Bcf while matching 2024 inventory changes will leave March inventories at 2,138 Bcf. With nearly two months remaining in the traditional withdrawal season, each weekly storage change will continue to remain impactful.