Natural Gas Boom for Permian Producers in 2025 & Beyond

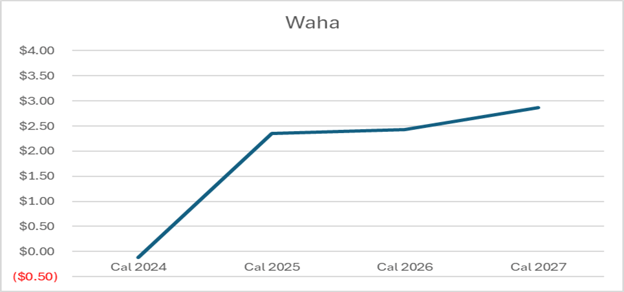

Waha cash prices have averaged an astounding -$.11 / MMBtu year to date in 2024. However, natural gas prices for 2025 delivery and beyond at the Waha trading hub in the Permian are dramatically higher.

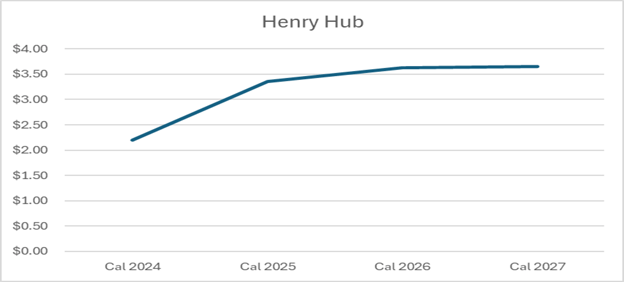

This is predominantly due to the Permian debottlenecking with the Matterhorn Express pipeline expected to come online in Q4 2024. LNG and other pipeline projects will further debottleneck the basin and allow Permian natural gas prices to catch up to most of the rest of the natural gas pricing markets. The expected increase in natural gas prices beyond 2024 in Waha is much larger than the expected increase in natural gas prices at the Henry Hub.

The large increase in natural gas prices at Waha will produce a large increase in 2025 earnings and free cash flow for the Permian producers should cash prices at Waha actualize around current forward curve pricing. Devon Energy as an example produces 712 MMcf/d in the Permian basin. 2025 Waha natural gas prices are $2.50 / MMBtu higher in 2025 than what cash prices have realized in 2024. This would equate to an increase in earnings of $1.8 million per day and an annual increase of $657 million in 2025. Devon Energy is expected to have earnings of $3 billion in 2024 which would make the $657 million increase in 2025 equate to a 20% increase in earnings for 2025 from higher natural gas prices. 2025 looks to be a much better year for the Permian producers.