EQT SHUT-INS LIKELY TO CONTINUE INTO APRIL

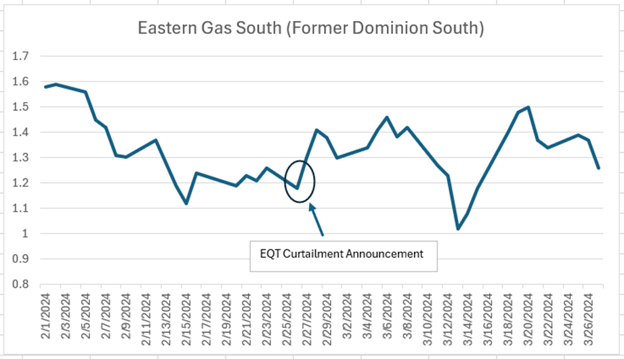

Cash prices at Dominion South (known as Eastern Gas South today) have come back down to price levels where EQT had announced back in late February 2024 that the company had decided to curtail 1 Bcf/d of production in the dry gas Southwestern Pennsylvania area of the Marcellus basin.

EQT’s variable cost break-even level is around $1.27 / MMBtu based on pure dry gas economics with no netback benefit of natural gas liquids and crude oil. Therefore, it made sense for the company to begin curtailing some natural gas production in the dry gas area of Southwestern Pennsylvania. Dominion South cash prices did rebound back up to around $1.50 / MMBtu and had prices hovered around the $1.50 / MMBtu, EQT probably would’ve brought back the curtailed production. But alas, as is the case lately for natural gas prices, they never fail to disappoint, and prices have come back down to the shut-in pricing level of around $1.27 / MMBtu. This of course is occurring during bid week when weighted average cash market pricing will be used to set First-Of-Month baseload pricing for the entire month of April 2024.

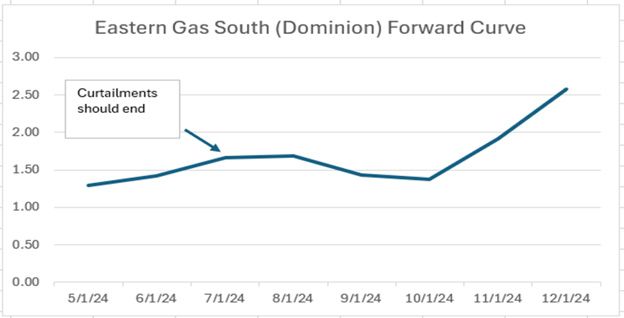

Looking at the forward Eastern Gas South (or Dominion South) curve, prices for May 2024 and June 2024 continue to hover near the curtailment pricing levels where EQT made their production shut-in announcement.

It isn’t until July 2024, where prices go significantly back above the curtailment pricing levels of around $1.30 / MMBtu. Therefore, the natural gas market would likely see many days of curtailments and choke backs from now until we get into the meat of summer beginning in July.