SynMax Research:

Earnings Highlights PTEN

|

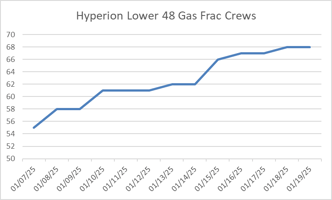

Patterson UTI (PTEN) Patterson’s Q2 2025 activity was in line with market expectations. While current oil prices would typically support higher drilling and completions activity than what the company is seeing today, Patterson’s customers have remained cautious as macroeconomic uncertainties persist. The company believes that if oil-directed activity does not recover from current levels, the market will likely see a larger negative impact on U.S. oil production than what has been witnessed so far. This is encouraging for the longer-term outlook relative to current activity levels. In the natural gas basins, activity improved slightly in Q2 2025 and has remained steady into Q3 2025. Patterson is having increased conversations around additional natural gas directed activity as 2026 approaches. The company continues to see long-term upside to natural gas directed activity as U.S. producers look to satisfy both rising domestic demand and growing global demand for U.S. LNG. |