SynMax Research:

Earnings Highlights DVN, EQT, & EXE

SynMax Research:

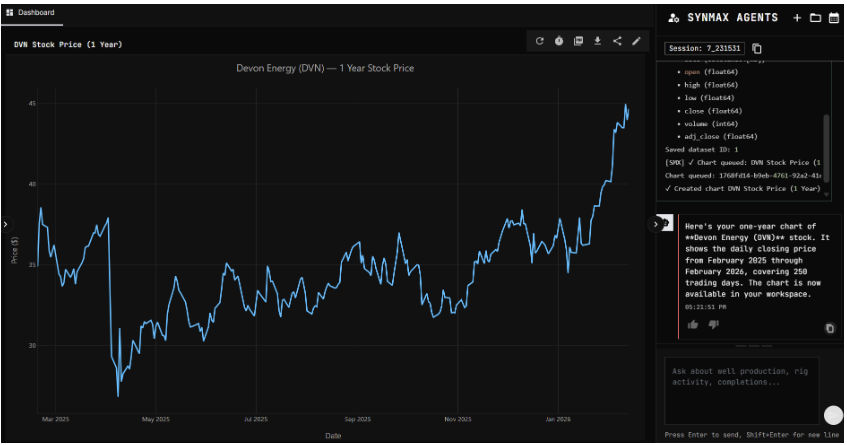

Devon Energy (DVN)

The announced merger with Coterra Energy is expected to close in Q2 2026. Devon Energy’s Q4 2025 production exceeded the top end of guidance for Q4 2025.

Production in Q1 2026 is estimated to be reduced by 1 percent sequentially due to the impact of severe winter weather. The company issued full year 2026 natural gas production guidance, which is expected to be roughly flat YOY.

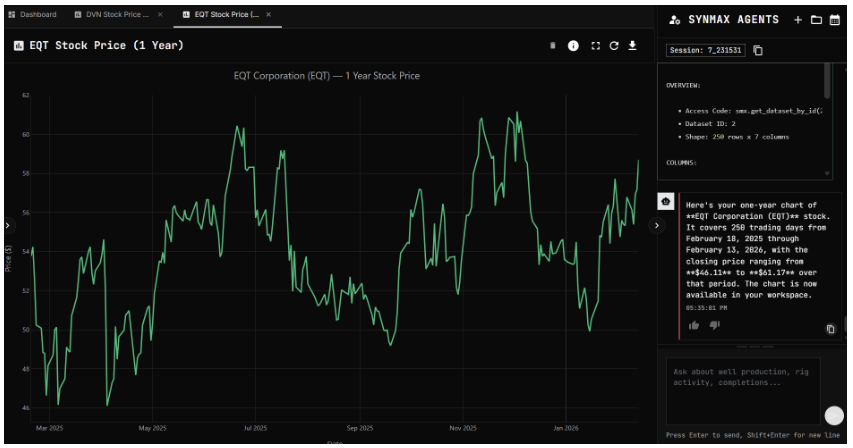

EQT (EQT)

EQT’s Q4 2025 production was above the high-end of guidance due to strong well performance, system pressure optimization, and lower-than-expected price related curtailments. CapEx was 4% below the mid-point of guidance, benefiting from operational efficiency gains and lower-than-expected infrastructure spending.

EQT broke multiple efficiency records once again in Q4 2025, including fastest quarterly completions pace and most lateral footage drilled in 24 and 48 hours. 2025 average well cost per foot was 13% lower year-over-year and 6% below company internal expectations.

The company issued full year 2026 natural gas production guidance, which is expected to be slightly lower YOY.

Expand Energy (EXE)

In Q4 2025, Expand Energy’s production increased 15% compared to Q4 2024. The company continues to prioritize the balance sheet with continued debt reduction of at least $1 billion.

The company’s full year 2026 production guidance is unchanged from the prior reporting period. Their 2026 production is expected to be higher YOY by 4.6%, with Haynesville growing at more than double the Northeast growth rate. In 2026, the company expects to increase production with lower CapEx.

In 2026, Expand Energy expects to run between 11 and 12 rigs. Hyperion data shows that Expand Energy is running 13 rigs average-to-date in Q1 2026.