SynMax Research:

Earnings Highlights CVX & XOM

SynMax Research:

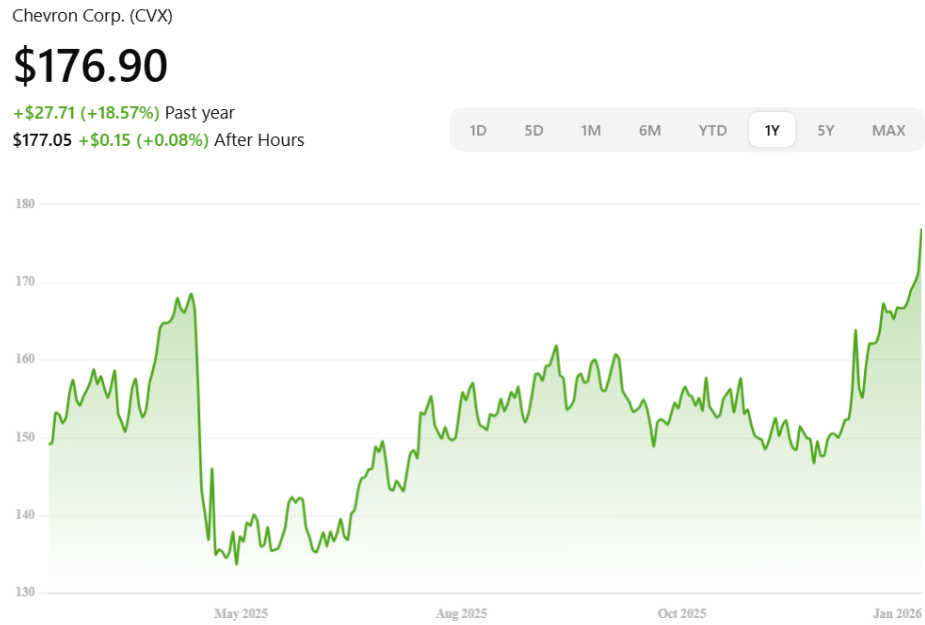

Chevron (CVX)

For the U.S. in 2025, several major projects achieved first oil in the Gulf of America and the Permian Basin delivered on its production target. Chevron began production from new wells and ramped up production at the Anchor, Ballymore, Stampede, and Whale fields in the deepwater Gulf of America.

Excluding impacts of the Hess acquisition, net oil-equivalent production growth was at the top end of the company’s 2025 guidance range of 6% to 8%. Production at TCO, the Permian and the Gulf of America was in-line with or better than previous guidance due to strong performance and disciplined execution.

Chevron expects volume growth to continue in 2026 as the company sees the benefits of project ramp-ups, a full year of Hess assets and continued efficiency gains in the shale portfolio. A full year of the Permian above one million barrels of oil equivalent per day and Bakken production underpin the expected growth. In total, growth in these high-margin assets is anticipated to contribute to a 7% to 10% increase in production year over year, excluding the impact of asset sales. The acquisition of Hess contributes to about half of the 7%-10% YOY growth in production.

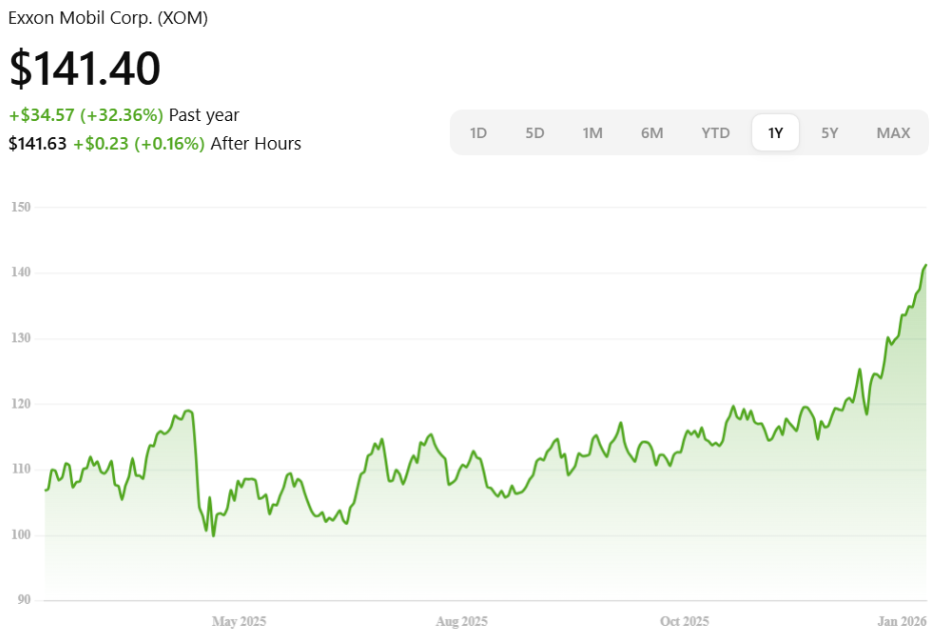

ExxonMobil (XOM)

ExxonMobil had its highest annual upstream production in more than 40 years. The company expects higher full-year Permian production in 2026. According to ExxonMobil, “There is no near-term peak in the Permian”.

Golden Pass is still expected to come online in Mar-2026. The company expects lower sequential production in Q1 2026 in the Permian due to freeze-offs. The company did not give any full year production guidance for 2026.