Antero Resources (AR) For Antero Resources, first quarter 2025 total production averaged right at...

Earnings Highlights AR, CRK, & NBR

SynMax Research:

Antero Resources (AR)

Antero Resources achieved a company record averaging 16.1 stages per day over an entire pad. The company closed the previously announced HG acquisition in early February.

Antero is expected to utilize 3 rigs and 2 completion crews. Hyperion's current rig count for Antero has averaged 2.4 rigs YTD. Hyperion's current frac count for Antero has averaged 1 frac crew YTD.

The company issued full year 2026 natural gas production guidance. Adjusting for the acquisition of HG Energy, the company's 2026 natural gas production is expected to be lower YOY. The lower YOY production guidance from Antero Resources will lower the long-term production forecast for 2026 in the Northeast.

Comstock Resources (CRK)

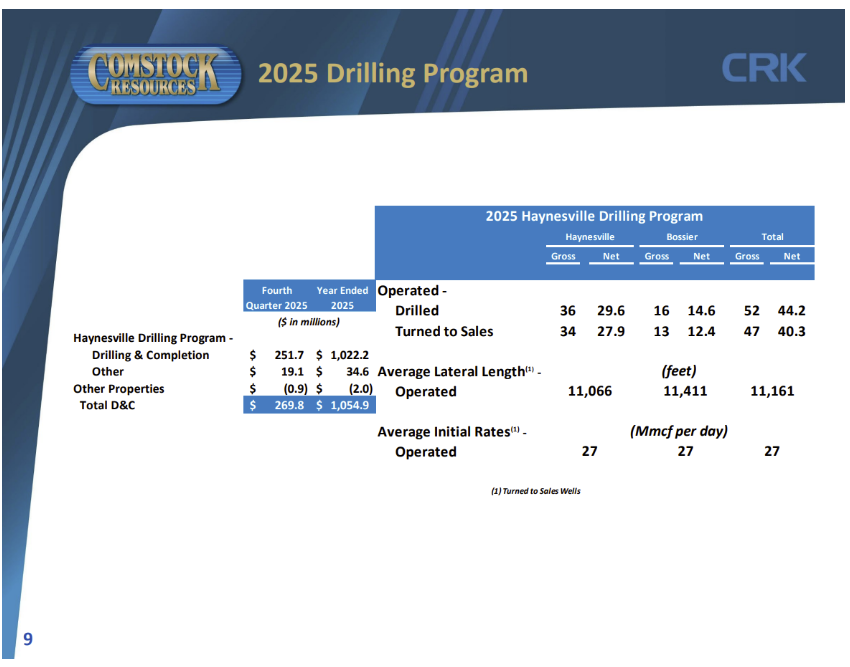

Four successful wells were turned to sales in the Western Haynesville in Q4 2025. During 2025, Comstock turned a total of 12 wells to sales in the Western Haynesville with an average per well initial production rate of 33 MMcf per day.

In response to improved natural gas prices, the Company currently plans to increase the number of operating drilling rigs it is running from eight to nine during 2026. Four of the rigs will be devoted to the Western Haynesville to continue to delineate the new play. The rest of the 5 rigs will be in their legacy Haynesville acreage. Hyperion’s current rig count for Comstock Resources has averaged 9 rigs YTD.

As a result, Comstock plans to spend approximately $1.4 billion to $1.5 billion in 2026 on its development and exploration projects and $100 million to $150 million on its Western Haynesville midstream system. 2025 CapEX was around $850 million.

The company issued full year 2026 natural gas production guidance. Their 2026 natural gas production is expected to be up substantially YOY using the midpoint annual guidance. Q1 2026 natural gas production is expected to be sequentially lower than Q4 2025 due to weather curtailments. This implies strong production growth in the second half of 2026. The strong YOY 2026 production guidance from Comstock Resources reiterates the strong YOY long-term production forecast growth for Haynesville. As a result, the long-term production forecast for Haynesville isn’t expected to change from the prior reporting quarter.

Nabors Industries (NBR)

In the fourth quarter, Nabors installed the first unit of its new Canrig® automated floor wrench on a Nabors rig working in the Haynesville Shale. This wrench represents a technological step-change for this critical rig floor component. Its field performance demonstrates a 30% reduction in cycle time and improved positioning. Available as a retrofit to Canrig wrenches deployed in the field, it is already generating significant customer interest.

The company operated 60 rigs in the Lower 48 by the end of Q4 2025. For Q1 2026, Nabors expects to see a Lower 48 average rig count of 64 - 65 rigs. For the full year 2026, Nabors expects to see a Lower 48 average rig count of 61-64 rigs.